ITR-5 IS NOW AVAILABLE FOR THE A.Y 2020-21

Due to the COVID-19 pandemic situation, the government has given relaxation to all the taxpayers and extended the due dates for filing ITR forms.

Earlier the form ITR-1, ITR-2, ITR-3, and ITR-4 were made available in the portal. On 25th August 2020, ITR-5 has been made available.

Who can file the form ITR-5?

ITR 5 Form can be used by Firms, Limited Liability Partnerships (LLPs), Association of Persons(AOP) and Body of Individuals (BOIS), Artificial Juridical Person, Cooperative society and Loc, subject to the condition that they do not need to file the return of income under section 139(4A) or 139(4B) or 139(4C) or 139(4D) (i.e., Trusts, Political party, Institutions, Colleges, etc.). Individuals, HUFs (Hindu Undivided Families), Companies are not eligible to use the ITR 5 Form.

Who cannot file the form ITR-5?

The Form ITR-5 should not be used by an Individual, HUF, Company, and person filing ITR-7.

PROCEDURE TO FILE THE FORM ITR-5:

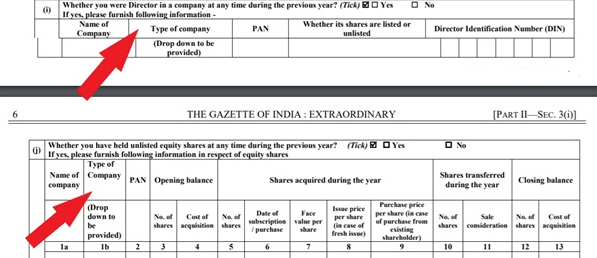

- Under Basic information in ITR 5, where assessee needs to disclosed about his directorship in companies or holding of unlisted equity shares, one new disclosure column is added here which is “Type of Company”

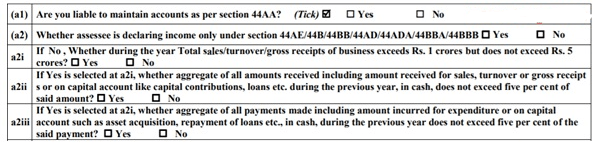

- Now there is new disclosure criteria regarding declaring income under presumptive income scheme such as section 44AE / 44B / 44BB / 44AD / 44ADA / 44BBA / 44BBB.

- There is additional disclosure in Other Information. Point No 11(da) and point No 17 is added.

- Point 11 – Any amount debited to profit and loss account of the previous year but disallowable under section 43B

- Sub Point (da) – Any sum payable by the assessee as interest on any loan or borrowing from a deposit taking a non-banking financial company or systemically important non-deposit taking the non-banking financial company, in accordance with the terms and conditions of the agreement governing such loan or borrowing

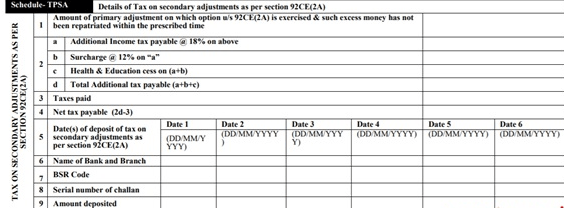

- Point 17 – Whether the assessee is exercising option under subsection 2A of section 92CE (Tick – Yes/ No) [If yes, please fill schedule TPSA]

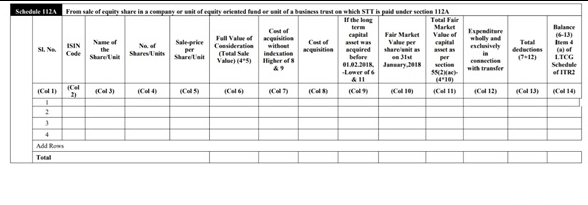

- Introduced New Schedule 112A – From the sale of equity share in a company or unit of equity-oriented fund or unit of a business trust on which STT is paid under section 112A

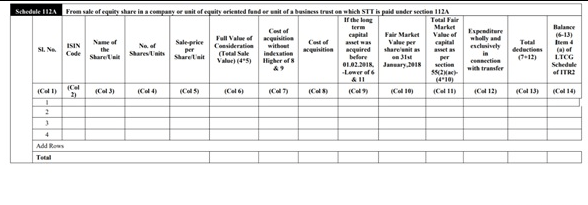

- Introduced New Schedule 115AD(1)(b)(iii) proviso – For NON-RESIDENTS – From the sale of equity share in a company or unit of an equity-oriented fund or unit of a business trust on which STT is paid under section 112A

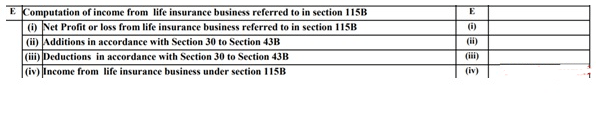

- Under Computation of income from business or profession, New section “E” is added i.e. Computation of income from life insurance business referred to in section 115B.

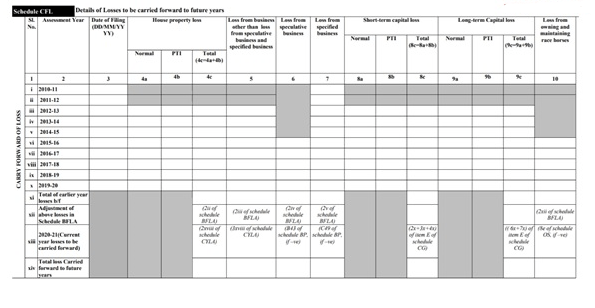

- In schedule CFL i.e carry forward of losses, now there is a requirement of bifurcation of loss details in two columns mainly Normal loss and PTI. This specification is required for House Property, Short Term Capital Gains, and Long Term Capital Gains.

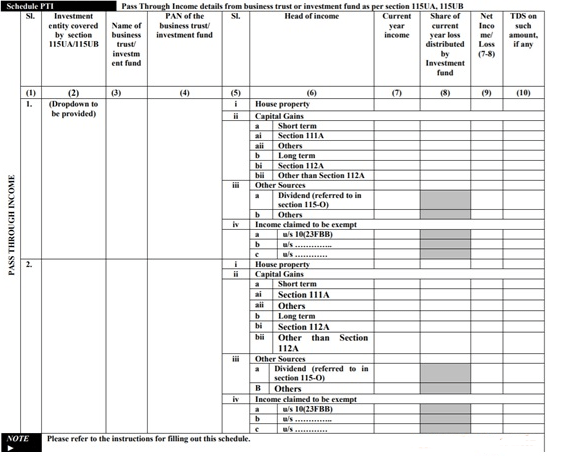

- There are some additional disclosures made under schedule PTI, which are as under:

- Investment entity covered by section 115UA/115UB

- Bifurcation of Amount as per the following 3 ways:

- Current year income

- Share of current year loss distributed by Investment fund

- Net Income/ Loss

- New Schedule – TPSA introduced – Details of Tax on secondary adjustments as per section 92CE(2A).

- New Schedule DI i.e. Details of Investments is inserted. As we all aware that the income tax department has allowed taxpayers the laxity of making certain tax-saving investments for FY 2019-20 till 30th June 2020 in view of the coronavirus lockdown. Deductions under Chapter-VIA-B of IT Act which includes Section 80C (LIC, PPF, NSC, etc), 80D (mediclaim), and 80G (donations) will now be allowed for spending till June 30th.

The dates for making an investment, construction, or purchase for claiming rollover benefit in respect of capital gains under sections 54 to section 54GB have also been extended to June 30.

Connect with our expert team for any assistance in doing this compliance. Connect on Whatsapp at 7417381631 or 7017698021 for more details