Online GST - Goods & Services Tax

Registration

Now increase your business faster and easily through 100% online process quick and affordable service. register your GST Registration (One Nation One Tax) just with #StartupSearch specialized professionals.

₹ 499 (All Inclusive)

Need to speak to an expert? Get Free Consultation

-

15,000+

Business Startup’s

-

4.9 / 5

Google Ratings

-

Get Free

Consultation

About Goods & Services Tax Registration

The Prime Minister Shri Narendra Modi approved “The constitution amendment bill for Goods and Service Tax”(GST) in the Parliament Session (Rajya Sabha on 3 August 2016 and Lok Sabha on 8 August 2016) along with the ratification by 50 percent of state legislatures.

Every business or corporation that are involved in the buying and selling and good of services have to register for GST. It is mandatory for companies whose turnover is more than Rs.20 lakhs (for supply of services) and Rs. 40 lakhs ( for supply of goods) yearly to register for a GST. It should be noted that GST registration must be applied within 30 days from the date becoming liable for registration. The penalty for non-payment & short payment of tax is prescribed at the rate of 10% of the tax amount subject to a maximum of Rs. 10,000. If there is deliberate evasion of tax then the penalty can be 100 % of the tax amount.

Startup Search Providers can help you obtain GST registration in India. The average time taken to obtain GST registration is about 2 – 3 working days, subject to government processing time and client document submission.

What Is Included In Our Package?

- Consultation

- GST HSN Codes with Rates

- Application Preparation

- GST Invoice Formats

- Document Preparation

- GST Certificate

- Consultation

- Application Preparation

- Document Preparation

- GST HSN Codes with Rates

- GST Invoice Formats

- GST Certificate

Procedure For GST Registration

Basic Details Form

Documents Submission

Application Filing

GST Certificate

Congratulations

Types of Goods & Services Tax (GST)

India has a Dual GST Model. Under this tax maybe levied simultaneously by both Central and State governments on certain taxable supplies. Such as on inter-state supplies, tax is levied by Central Government.

| Features | Central GST – CGST | State GST – SGST | Integrated GST – IGST |

|---|---|---|---|

| Tax Levied By | Central Government on Intra-State supplies of Goods and/or Services | State Government, on Intra-State supplies | Central Government, on Inter-State supplies |

| Applicability | Supplies inside a state | Supplies inside a state | Interstate supplies and import |

| Input Tax Credit | Against CGST and IGST | Against SGST and IGST | Against CGST, SGST, and IGST |

| Tax Revenue Sharing | Central Government | State Government | Shared between State and Central governments |

| Free Supplies | Applicable | Applicable | Applicable |

What are the GST tax rates?

- Items that are considered basic necessities come under exempt list i.e. they are not taxed.

- Household necessities and life-saving drugs etc. are taxed at 5%.

- Products like computers and processed food are taxed at 12%.

- Hair oil, toothpaste and soaps, capital goods, industrial intermediaries and services are taxed at 18%.

- Luxury items are taxed at 28%.

Who can apply for GST registration

All businesses involved in buying or selling goods or providing services, or both, should register for GST. But for below-listed persons, GST Registration is compulsory.

- Previous Law Converted Taxpayer –All individuals or companies registered under the Pre-GST tax laws like Service Tax or Excise or VAT, etc.

- Turnover for Goods Provider –If your sales or turnover of goods is crossing Rs. 40 lakh in a year then GST Registration is mandatory. For the Special Category States, the limit is Rs. 20 lakh in a year.

- Turnover for Service Provider –If you are a service provider & sales or turnover is crossing Rs. 20 lakh in a year then GST Registration is mandatory. For the Special Category States, the limit is Rs. 10 lakh in a year

- Casual Taxpayer – If you supply goods or services, in events/exhibitions, and not have a permanent place of doing business. In such cases, GST is charged on the basis of an estimated turnover of 90 days. The validity of the Registration is also 90 days.

- Agents of Suppliers or Input Service Distributor (ISD) – All supplier agents and ISD, to earn benefits of Input Tax Credit, need GST Registration.

- NRI Taxable Person – If you are an NRI or handling the business of NRI in India.

- Reverse Charge Mechanism (RCM) –Businesses who need to pay taxes under the RCM also need to be GST registered.

- E-Commerce Portals & Sellers –Every e-commerce portal (such as Amazon or Flipkart) under which multiple vendors are selling their products. Or for all vendors. You need a GST Registration.

-

- Outside India Online Portal– For suppliers of online information and database access or retrieval services from a place outside India to Indian Residents.

- Transferee– When the business has been transferred.

- Inter-State Operations– Persons making an inter-state supply. Whatever the turnover.

- Brands – Aggregator who supplies service under his Brand or Trade Name.

- Other Taxation– Persons who are required to deduct tax u/s 37 (TDS) of the Income Tax Act.

- Voluntary GST Registration– Any entity can obtain GST registration at any-time. Even when the above mandatory conditions don’t apply to them.

- Inter-State Registration– If you are a supplier in more than one state you need GST Registration in all the states that you supply goods or services to.

- Branches – If your business has multiple branches in multiple states, register one particular branch as main office or head office and the remaining branches as additional. (Not applicable if the business has separate verticals as listed in Section 2 (18) of the CGST Act, 2017.)

- The Special Category States under GST Act are:

(a) Arunachal Pradesh, (b) Assam, (c) Sikkim, (d) Meghalaya, (e) Tripura, (f) Mizoram, (g) Manipur, (h) Nagaland, and (i) Himachal Pradesh. These states can opt for tax payable at a concessional rate.

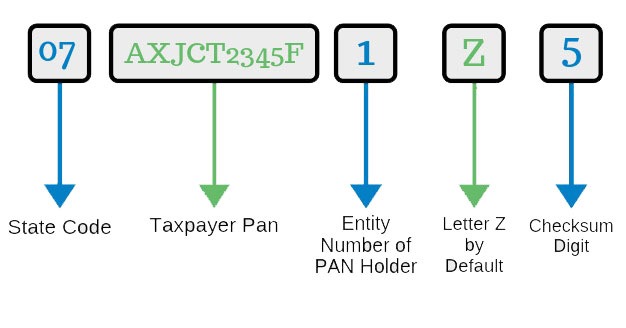

What is GSTIN?

- GSTIN is a unique 15-digit alphanumeric code that is allotted to each Firm/Company/Individual, who are registered under GST.

- The government has ensured that everything under GST is digital so that there is maximum transparency with minimum corruption.

- The first 2 digits of the GSTIN represent the state code which is given as per the 2011 census.

- The first 2 digits of the 15 digit GSTIN will represent the state code. For example: 01 for Jammu and Kashmir, 02 for Himachal Pradesh, 03 for Punjab, etc.

- The next 10 digits are the PAN number of the entity.

- The 14th digit is Z by default.

- The 15th or the last digit is the Checksum digit. It comes, automatically, as a result of the calculation of the other 14 digits.

Documents Required For GST Registration

Proprietorship Firm

- Aadhaar card, PAN card, and a photograph of the sole proprietor

- Details of Bank account- Bank statement or a canceled cheque

- Office address proof:

-

- Own office –

- Rented office – Rent agreement and NOC (No objection certificate) from the owner.

LLP & Partnership Firm

- Aadhaar card, PAN card, Photograph of all partners.

- Details of Bank such as a copy of canceled cheque or bank statement

- Proof of address of Principal place of business and additional place of business :

-

- Own office –

- Rented office – Rent agreement and NOC (No objection certificate) from the owner.

For Pvt. Ltd. /Public Ltd./OPC

- Company’s PAN card

- Certificate of Registration

- MOA (Memorandum of Association) /AOA (Articles of Association)

- Aadhar card, PAN card, a photograph of all Directors

- Details of Bank-bank statement or a canceled cheque

- Proof of address of Principal place of business and additional place of business :

-

- Own office –

- Rented office – Rent agreement and NOC (No objection certificate) from the owner.

Minimum Requirements For GST Registration

- Valid mobile number & email address

- Registration proof (Partnership Deed, LLP Agreement or COI in case of Company)

- Bank account details

- Proof of appointment of authorised signatory

- Photograph of authorised signatory

- Existing VAT/CST, Excise, Service tax registration certificate

- Valid mobile number & email address

- Bank account details

- Photograph of authorised signatory

- Registration proof (Partnership Deed, LLP Agreement or COI in case of Company)

- Proof of appointment of authorised signatory

- Existing VAT/CST, Excise, Service tax registration certificate

Advantages of GST Registration

With the implementation of GST in India, the indirect taxes would be streamlined and standardized. Under the GST regime, businesses would no longer have to obtain multiple VAT registration in different States or obtain a separate VAT and Service Tax registration. A single GST registration for the respective state(s) in India from where the supply of goods and/or services will be sufficient.

Input Tax Credit or ITC

Inputs are all those goods that went into creating the finished products provided to the final consumer. Businesses are charged GST on goods/services that are used as inputs. The ITC mechanism allows GST registered businesses to receive refunds on the GST paid for purchasing all inputs. This helps prevent cascading taxation effect, which was the primary reason behind introduction of the GST.

For instance: GST payable on the supply of the final product of a manufacturer is Rs. 850 and the GST paid on inputs is Rs. 725. The manufacturer can claim the Rs. 725 as ITC. This brings the net tax payable at the time of supply to Rs. 125 only (Rs. 850 – Rs. 725).

Under the previous indirect tax regime of levy of Service Tax, VAT, and Excise – a lot of input tax credit was not properly utilized.

Who are eligible to claim Input Tax Credit?

ITC is available only to those entities who have registered under the GST Act. Only GST registered businesses can claim ITC on the tax paid for the purchase of any business relevant inputs.

Who cannot claim ITC?

Input Tax Credit can be claimed only for business purposes. It is not available for goods or services exclusively used for:

- Personal use,

- Exempt supplies,

- Supplies for which ITC is specifically not available.

Apart from the above, there are some other cases where ITC will be reversed. Such as Credit Note issued to ISD, Non-payment of invoices within 180 days, assets bought partly or wholly for exempted supplies or personal use, etc.

Conditions for claiming Input Tax Credit

- GST invoice showing details of tax paid is necessary,

- The goods on which GST has been paid have been received by the consumer,

- The applicant has filed the relevant tax returns,

- The supplier had paid the due tax to the government,

- The ITC applicant is registered under GST,

- If goods were received in installments, ITC can be claimed only after the final lot has been received.

ITC cannot be claimed if:

- Composition tax registered entities paying GST on inputs,

- If depreciation has been claimed on the tax part of a capital good,

- On goods not used as inputs such as supplies for personal use,

- On goods on which ITC is not applicable under the GST Act (exempted goods).

Input tax credits can be used as:

- CGST input tax credits are allowed to be used to pay CGST and IGST,

- SGST input tax credits are allowed to be used to pay SGST and IGST,

- IGST input tax credits are allowed to be used to pay CGST, SGST, and IGST.

GST Registration Process on Government Portal

To register for GST on the Government site, you need to follow the below steps. Cautiously & Accurately.

- Go to the Government GST Portaland look for Registration Tab.

- Fill PAN No., Mobile No., E-mail ID and State in Part-Aof Form GST REG-01 of GST Registration.

- You will receive a temporary reference number on your Mobile and via E-mail after OTP verification.

- You will then need to fill Part-Bof Form GST REG-01. To be duly signed (by DSC or EVC) and upload the required documents specified according to the business type.

- An acknowledgment will be generated in Form GST REG-02.

- In case any information is pending from your side. It will be sought from you by intimating you in Form GST REG-03. for this, you may be required to visit the department and clarify or produce the documents within 7 working days in Form GST REG-04.

- The office may also reject your application if they find any errors. You will be informed about this in Form GST REG-05.

- Finally, a certificate of registration in Finally, a certificate of registration will be issued to you by the department after verification and approval in Form GST REG-06

Frequently Asked Questions

Goods and Services Tax (GST) is a comprehensive tax levied on manufacture, trade and services across India. From 1st July, 2017 GST will replace most of Centre and State imposed indirect taxes like VAT, Service Tax , Excise etc. Goods and Services Tax Identification Number (GSTIN) is a 15 digits state-wise PAN-based number to be used to identify businesses registered under GST.

-The GST council has decided on a four-tier structure. The GST rate will depend on the type of goods and services. Currently, the slab rates are0%, 5%, 12%, 18% and 28%. The rate for gold is yet to be decided, and will likely to be the lowest of all.

PAN is mandatory to apply for GST registration (except for non-resident person who can get GST registration on the basis of other documents).

– If you’re an existing taxpayer registered under any of the below mentioned authorities, then you are Liable to migrate and enroll under GST system portal. Central Excise, Service Tax, State sales tax/VAT (except exclusive liquor dealers), Entry tax Luxury Tax, Entertainment tax .

A supplier of goods, with an annual turnover of Rs. 40 lakh (Rs. 20 lakhs for special category States), must apply for GST registration. There are certain cases where the taxable person is liable to pay GST even though his turnover has not crossed this limit.

Those providing services must get GST registration, once their turnover crosses Rs.20 lakhs and in case of Special Category States at Rs 10 lakhs.

All existing taxpayers registered under any of the Acts as specified will be transitioned to GST. The enrolment for GST will ensure smooth transition to the GST regime. The data available with various tax authorities is incomplete and thus fresh enrolment has been planned. Also, this will ensure latest data of taxpayers is available in the GST database without any recourse to amendment process, which is the norm to update the data under tax statutes today.

Yes, the mobile number and e-mail address can be changed after the appointed date on following the amendment process.

The Provisional Registration Certificate will be available for viewing and download at the Dashboard of the GST Common Portal on the appointed date. The certificate will be available only if the Registration Application was submitted successfully.

Yes, the Enrolment Application for enrolment under GST can be rejected in case incorrect details have been furnished or uploaded fake or incorrect documents have been attached with the Enrolment Application and the application is electronically signed. However, the applicant taxpayer will be provided reasonable opportunity of being heard where applicant taxpayer can present his or her viewpoints.

The final Registration Certificate will be issued within 6 months of verification of documents by authorized Center/ State officials of the concerned Jurisdiction (s) after the appointed date.