STEPS TO FILE ITR-2 FOR THE A.Y 2020-2021

In the view of Difficulties faced by the taxpayers due to COVID-19 pandemic situation, the Government vides Income Tax notification dated 24 June 2020, has extended the deadline for filing return of income for A.Y. 2020-21 from the original due date of 31st July 2020 to 30th November 2020.

Who can file ITR-2?

- Individual/HUF (Resident)

- Total Income exceeding Rs.50 Lakhs

- More than One House Property

- Salary/Pension Income

- Foreign Assets/Foreign Income

- Agriculture Income more than 5000

Who cannot file ITR-2?

- Profits/Gains from Business

- Profits/Gains from Profession

Key points to be remembered:

- The taxpayers having self-assessment tax liability exceeding Rs. 1 lakh are advised to file their ITR 2 in time as there will be no extension of date for the payment of self-assessment tax for them.

- The self tax assessment liability exceeds Rs 1 Lakhs, the whole of the self-assessment tax shall be payable by the due date (31st July 2020) specified in the Income-tax Act, 1961, and delayed payment would attract interest under section 234A of the IT Act.

Procedure to file ITR-2 step by step (Online):

Step 1: Go to the website incometaxindiaefiling.gov.in

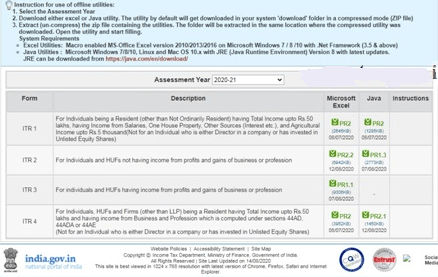

Step 2: Click on IT Return Preparation Software>Right side>Download> IT Return preparation Software.

Step 3: Download Microsoft Excel & Java Utility in the same folder. PC should have Java Run Environment (JRE) version 8 with the latest updates.

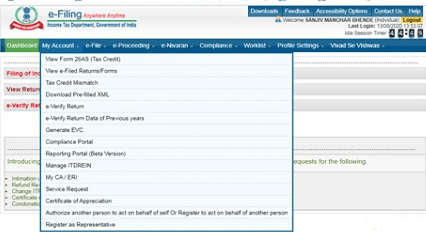

Step 4: Login to the account (incometaxindiaefiling.gov.in). Go to My Account and then Download Pre-filled XML (Auto captures the basic details, tax paid from Form 26AS and Form 16, etc)

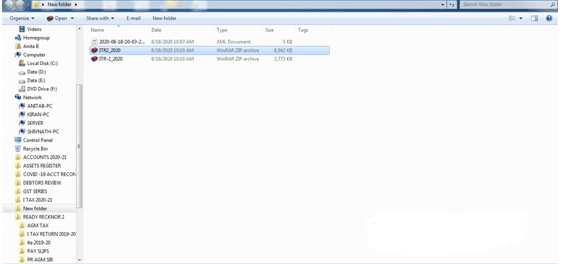

Step 5: Go to the folder where you downloaded Microsoft Excel, Java & Pre-fill XML File.

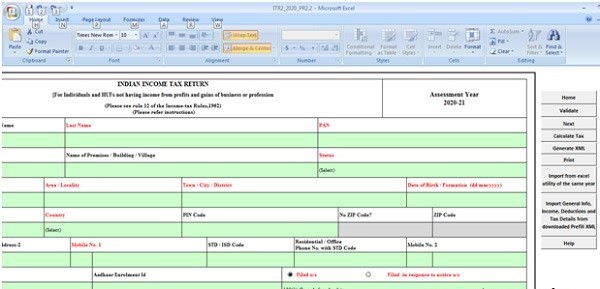

Step 6:Click on Zip File (ITR2_2020) then click on next.

Step 7: Click on import general file from pre-fill XML.

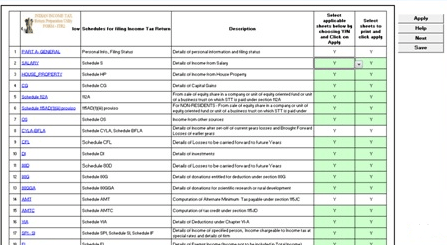

Step 8: Verify the details in pre-filled XML and entered other requisite details.

Click on Calculate tax, Validate and Generate XML File.

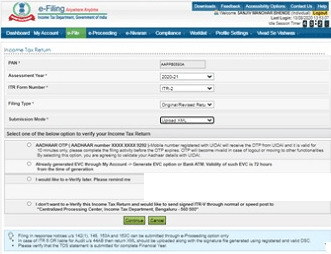

Step 9: Log in to incometaxindiaefiling .gov.in

Go to e-file, upload the XML file and Verify Income Tax Return

Hurry up! file your ITR-2 immediately to avoid penalties. You can file it by yourself or connect with us at StartupSearch our Professionals will help you to file your ITR-2 in the easiest way.

Connect with our expert team for any assistance in doing this compliance. Connect on Whatsapp at 7417381631 or 7017698021 for more details